Resources

Our repository of knowledge featuring interesting insights and practical applications of our products and services.

Blogs

By Pelatro Solutions

Blogs

How to fix Business Transformation Dampeners in large Telecom/BFSI enterprises

Enterprises, small or large, are always in a phase of change. Peek into the program management office of any large (annual revenues in excess of a billion dollars) telco or bank, and you will easily find at least a dozen transformation projects tagged under Digital / Customer Centricity / Crypto Assets / Data Consolidation / Metaverse. Also incumbent is a huge army of highly skilled engineers, architects and domain experts from the marquee list of ISVs, consulting firms and system integrators, all marching committedly toward the zenith of customer centricity, as everyone already knows that is the only way for businesses to survive, let alone flourish.

Yet research says those transformation efforts fail most of the time. Why? Perhaps there are many reasons: strategic mistakes with goal setting, tactical flaws in planning, operational errors during execution. In this article, I shall narrow down these issues, those that are largely in our control, and suggest a few ways to overcome them.

1. Don’t let FOMO be the driver.

Put your horse before the cart. A competing bank’s marketing campaign focused on NFT-backed digital artifacts for loyalty exerts a lot of pressure on all peers. But before onboarding a vendor to provide the backbone for crypto assets, the marketing team should list a handful of concrete use cases and assess their relevance/appeal to the bank’s customer base.

For instance, create a concrete use case like this:

“My Telco X shall mint 1,000 celebrity-signed SIMs accompanied by a collectible, say a coffee mug or watch, and distribute it to our most loyal customers. The SIM and the collectible are digitally coupled and tokenized using NFTs, making this a limited-count asset now. Customers (may) take pride in owning it. We may incite demand as the asset is limited. We may host an exclusive “Celebrity Collectible Owners Club” with the access key being the NFT itself.”

And if it sounds logical, then onboard a partner to realize the vision.

2. Remove self-imposed constraints.

Most enterprises lock themselves in with only one vendor for a specific function and let them handle the entire customer base. For instance, one vendor for CCCM, one for RTIM, one for digital analytics, etc. And each one of them caters to the whole base of 100 million customers.

Enterprises seek advanced capabilities like A/B testing from those products but do not themselves practice A/B testing with multiple vendors, where, say, two competitor products are pitted against half the customer base.

In today’s contemporary tech landscape, with most vendors taking the SaaS route, operational considerations of yesteryears should not be held as blockers for having multiple incumbent competing products.

3. Diffuse the tension between IT and business.

A common trait I find in market leaders is the presence of absolute synergy between IT and business. Meanwhile, I notice the opposite in laggards. But both are wrong and need a realignment in order to put the end customers ahead of their own priorities.

Having IT and business aligned on the right “customer” axis is pivotal to ensuring smooth and successful outcomes.

4. Don’t go for blind AI; seek explanations.

It is sad but true that even large enterprises fall prey to machine learning’s (ML) glamour and onboard many AI-heavy projects, allowing their systems to make a lot of decisions without sufficiently understanding the rationale behind them.

In their race against time, enterprises have a tendency to choose those vendors that ship with a lot of pre-built models, and knowing the trend, vendors have also inflated their stock model count. This is a potentially dangerous practice, one that can uproot a brand’s stated emphasis on customer centricity. Enterprises need to make sure they choose vendors that can provide a rationale, in business terms, for the recommendations and actions they undertake, and not go by arbitrary numbers emitted by mathematical models based on never-understood matrix transformations.

For example, if Alice was recommended a four-year mortgage loan while the CSR opines that a three-year unsecured loan is a better option, the CSR should be able to ask the underlying ML as to why it deemed mortgage to be a better option for Alice. In response, the ML should be able to give reasons in business terms (e.g., “Analysis of Alice’s cohorts reveals that there is a 3x increase in chances of bad debt when they consider a loan within six months of engaging with the bank” and not an apparently useless metric (e.g., “Alice’s proximity score to four of the deduced clusters is 0.3, 0.4, 0.1 and 0.2 with a noise level is 0.86—that’s my recommendation”).

5. Be rational and also understand the data limitations.

I have sat through business workshops on customer centricity where the need for brands to connect with the “whys” behind customer engagement is well understood, and then, we come up with a purpose for customer interaction like “To open a fixed deposit for 12 months.” There is an apparent disconnect here.

An end customer like Bob will possibly engage with an intention of “Putting idle money to better use” and possibly wants a safe bet. Hence, his preference for deposit over equity. Thinking from Bob’s perspective, fixed deposit is just a means, not his objective, and until you understand this subtle difference and align accordingly, you will never be able to transform your company into a truly customer-centric brand.

While there is no prescription for success, as Otto von Bismarck rightly said, the wise man learns from the mistakes of others. Not rushing into the same pitfalls others have just managed to come out of is important to stay on the right track.

Want to know how Pelatro can help you improve your customer engagement? Get in touch at hello@pelatro.com

Author

Chief Architect at Pelatro. Proud to help 40+ Telcos/BFSIs offer the finest contextual marketing experience to their 1B+ subscribers. Read Pramod Konandur Prabhakar’s full executive profile here.

This article was originally published here.

By Pelatro Solutions

Blogs

How Banks Can Manage the Customer Satisfaction and ROI Tug-Of-War

Chief marketing officers in banks, like their peers elsewhere, are stuck in a tug-of-war between customer satisfaction and ROI.

Gone are the days where customers were happy with only a waiver on late-payment fees. While everyone enjoys freebies, they don’t always translate to increased assets under management or loyal customers. That said, taking an iron-fist approach with profits to please the board can cause an enterprise to fall from grace with customers.

How BFSI Marketing Teams can find the Right Balance

Enterprises are aware of this friction. Businesses need profit, and the management is accountable for investors’ money. Customers, on the other hand, expect to be pampered. BFSI enterprises are having trouble finding the right balance. They generally take one of two approaches:

1. Top-Down: With this approach, the business goals and targets are set from above. Sales and marketing divisions are tasked to achieve these goals, and customer experience can take the back seat.

2. Bottom-Up: With this approach, CSAT scores and customer priorities take the front seat. Key result areas are generally tied to sales without accounting for costs. These companies are busy acquiring customers and keeping them happy while profitability takes a back seat.

That said, banks—like most companies—must find ways to balance these two approaches. Here are a few ways to find that balance:

1. Make both “customers interests” and “enterprise objectives” CMO/CSO priorities.

Enterprises should discover the whys behind customers engaging with their brand. They should nudge those customers toward their individual goals using the enterprise’s product offerings and experiences. In doing so, they can’t assume an infinite supply of resources or cash. The products and discounts—including any freebies and vouchers—should be rationed from a pre-allocated budget.

For example, when John visits a bank’s website and clicks a few times around the 8PC_Personal_Loan_1Y product, he shouldn’t be incessantly nudged toward signing up for that product. The bank must first establish a connection with John’s underlying purpose, which could be “short-term credit need.” After that, the bank should work out the case from John’s perspective, taking into consideration his assets and liabilities, products held, credit rating, etc. Finally, the bank can recommend multiple products that help him realize his purpose, which might include “loan at 2% on top of his deposits.”

When recommending the 2% deposit product to John, sales and marketing should be aware that they may be doing so at the expense of possibly recommending the same to Alice, as there should be a rationed quota of products to sell to achieve the desired profit margins.

2. Build hierarchical journey plans.

Based on the above example, banks must build three kinds of customer journey plans: strategic, tactical and operational.

A. Strategic journeys focus on objectives and verifiable targets but do not specifically talk about means to achieve those targets. They always work on aggregate milestones—not in an individual customer’s context—and may cover multiple objectives.

For example, the bank could lay out the quarterly revenue and sales targets with monthly milestones alongside broad annotations:

Month 1: $2 million investments, 25,000 new product sales

Month 2: $1 million investment

Month 3: $3 million investment, 50,000 product sales

Overall goal: Of the 75K new product sales, at least 50% should be upsell and 30% cross-sell.

B. Tactical journeys are defined in the context of individual customers. They don’t carry a complete prescription of all steps from start to end of the journey, and they can have multiple branches along the way. They are defined on a persona and may delegate orchestration to operational journeys, which are described below.

A good tactical journey caters to a single objective from a strategic journey. The bank could, for example, define the five-months journey for first-time-earner persona. This could include monthly guidance milestones to assess progress at the individual level as well as triggering campaigns at stipulated intervals or in response to certain user activity:

Month 1: Ensure no customer complaints and all KYC are complete.

Month 2: Complete zero-party data survey.

Month 3: Recommend two products based on behavioral and contextual data.

Month 4: Check if the customer has signed up for at least one new product since onboarding.

Month 5: Assign a persona based on portfolio value and take a first guess at CLTV.

3. Operational journeys are largely contextual in nature and do not necessarily align with any specific business objectives. They are reactive in order to provide the best customer experience.

A detailed flow diagram, for example, should be based on personalizing engagements by taking into consideration user clicks, activity and inactivity on the banks’s website and app. In doing so, stitch together user actions across channels—such as KYC completed, responded to surveys, etc.—in order to have holistic context for nudging customers.

4. Implement strategies and adopt technology to achieve business goals.

Once journeys are developed, banks should revitalize the marketing and sales activity to align with the hierarchical journeys above. During this process, the CMO and/or CSO team should define top-level strategies alongside enterprise goals and operational constraints.

Technology plays an important role here. For example, domain specialists and analysts punch in the broad outline of tactical journeys, while technology, such as an ML-backed enterprise marketing tool, can take responsibility for curating the actual operational journeys.

Conclusion

To realize large successful business transformations, BFSI enterprises need to maintain equal focus on CSAT and profits. They need to work out a sales and marketing strategy where enterprises serve as a bridge helping customers meet their personal financial goals without taking blind-folded customer-centricity approaches.

Sound journey planning leveraging on strategical, tactical and operational journeys while empowering teams with technology. Only then can companies find the right balance to serve both customers and investors.

Want to know how Pelatro can help you improve your customer engagement? Get in touch at hello@pelatro.com

Author

Chief Architect at Pelatro. Proud to help 40+ Telcos/BFSIs offer the finest contextual marketing experience to their 1B+ subscribers. Read Pramod Konandur Prabhakar’s full executive profile here.

This article was originally published here.

Case Studies

The telecom operator wanted to create a 360-degree customer profile to run ‘segment of one’ marketing campaigns in real-time. But the existing solution lacked AI/ML capabilities to do real-time analytics, configure AB testing models, and execute, monitor, and evaluate the campaign effectiveness.

The client needed a new-age solution to rejuvenate its Loyalty Management program. In-house built legacy systems had started wearing out. mViva Loyalty Management System from Pelatro has added a level of dynamism allowing the client to analyse each customer (on behaviour) and channel relevant offers to a signed-up base of 13 million across multiple channels.

There was an imminent need for the client to replace legacy systems with a Contextual Marketing platform which supports an integrated approach to campaigning in the digital era. 4 years since the inception, multiple teams at the client use mViva Contextual Campaign Management Solution to design and drive hundreds of campaigns for both subscribers and retailers with tangible revenue impact.

A top Telco was seeking an end-to-end Multi-Channel Campaign Management solution capable of handling large volumes of data and deliver advanced features. Pelatro deployed a flexible Contextual Campaign Management platform which today processes 83 billion xDRs/day generating 1.6 billion offers/month with 20% incremental revenue.

Reeling under high churn rates, the client sought a comprehensive solution for managing CLV. Pelatro was tasked to develop a Campaign Management practice from scratch which included implementation, integration, resource management, training, and handover. Today, the client manages the platform independently processing 16 billion CDRs resulting in 54 million offers/month.

A leading CSP in the Caribbean was seeking an AI-ML based Contextual Marketing which could tap into the potential for higher ARPU. An end-to-end Campaign Management solution was deployed to run one-to-one marketing campaigns based on micro-segmentation resulting in 5% revenue impact and 16% avg. churn reduction

Infographics

By pelatro pink

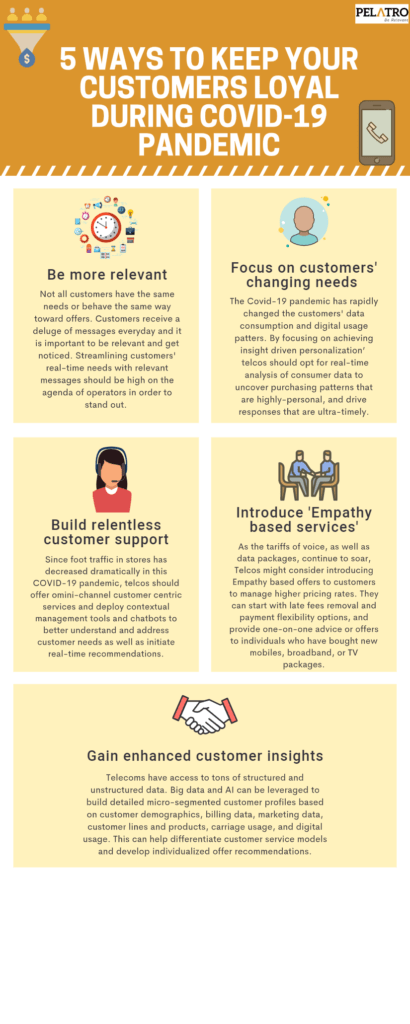

INFOGRAPHIC: 5 ways to keep your customers loyal during the COVID-19 pandemic

Connectivity has become critical for business continuity in the COVID-19 pandemic. Over the last few months, internet connectivity has become the lifeforce of global businesses, thereby fueling higher data consumption. The broad majority of consumers and companies have started opting for different offers and plans offered by Telcos. Given the growing and changing digital usage patterns, telecom companies should not leave any stones unturned to bring value to their customers’ life. According to a report from Forrester Research, it costs five times as much to acquire new customers than it does to keep the existing ones. Prior to the COVID-19 crisis, several Telcos tried to retain the lost customers by launching short-time promotional goals, and it did work effectively for some time. However, with customers’ expectations continuing to evolve at an unprecedented rate, operators must strengthen their marketing strategy and play a key role in helping customers’ sail through this crisis.

Whether the engagement is related to promotion or customer satisfaction, a reliable and substantial differentiator for the Telecom brand should be able to proactively offer or recommend an adapted or relevant solution before the customer starts searching. This strategy might aid in keeping customers loyal in this pandemic.

In addition, here are some tried ways that could keep your customers loyal in this COVID-19 pandemic.

By pelatro pink

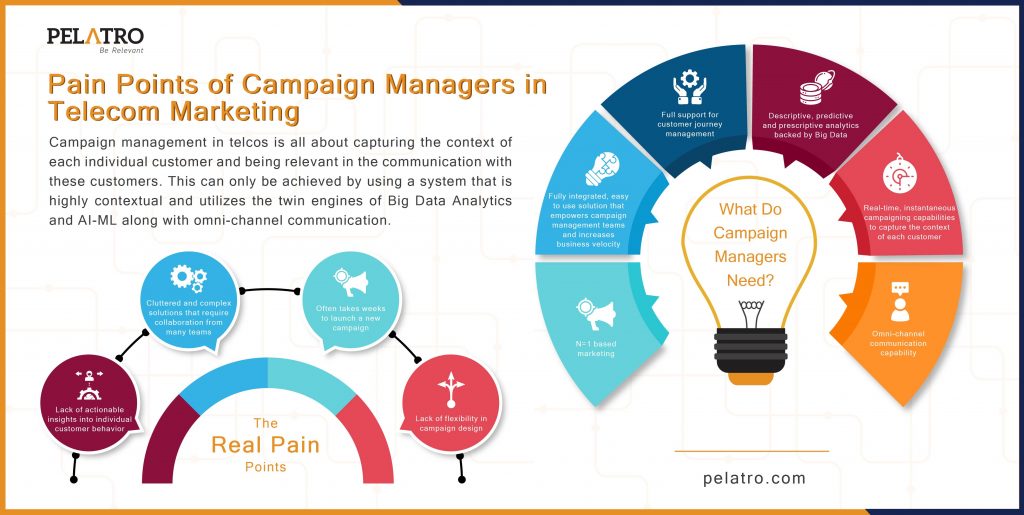

Infographic: Pain Points of Campaign Managers in Telecom Marketing

An illustration of the most common challenges faced by marketers in the Telecom industry and how they can be equipped to counter the pain points.

Flyers

By Pelatro Solutions

mViva for Banks

mViva offers a variety of features that help banks to achieve contextual marketing and thus increase the relevance of their offers. It uses machine learning algorithms to assist users in creating optimal campaigns.

By Pelatro Solutions

Solving Business Critical Challenges with Use Case as a Service

Pelatro’s UCaaS or Use Case as a Service model enable telecom operators to take on the immediate business concerns such as increase churn, falling ARPU, low engagement in no time. The solution can be deployed on any existing campaign management solution and offers an innovative engagement model to ensure shorter time to market and high ROI by operating in a truly agile mode.

Why to choose the Pelatro’s UCaaS model

- Charged on a per use case per month basis

- Switch on and switch off the use cases at will

- No need to replace your existing Campaign Management vendor

- Shorter time to market for the use case in agile mode

E-books

By Pelatro Solutions

Campaign Optimization Hacks for Telecom Marketers

A telco marketer’s day is spent tracking all the hundreds of KPIs and analysing them to plan and optimize their campaigns. Do you do that as well? Are you able to optimize and generate better results from your campaigns?

Check out these interesting hacks that marketing teams at some of our telco customers are using to improve their marketing campaigns.

Webinars

By Pelatro Solutions

On Demand Webinar: Hyper-Personalisation 2.0- Redefining Telcos’ Customer Engagement Strategy

Whitepapers

Customer journey orchestration has been a hot topic for long now, but banks are yet to see the full potential of it. As their customers adapt to digital way of banking, retail banks have the opportunity to truly transform their customer engagement through purpose-driven customer journeys. Now the question is how you add purpose or the customer’s intent and make these journeys more meaningful for all the stakeholders.

Check out this whitepaper on how banks can use purpose-based customer journeys to deliver higher benefits to the customers and simultaneously improve their Marketing KPIs.